Margin trading therefore refers to the practice of using borrowed funds from a broker to trade a financial asset, which forms the collateral for the loan from the broker. But of course, the reason they were able to do so as they had the financial discipline to obtain such a non-callable low-interest loan in the first place. These amounts are set by the Federal Reserve Board, as well as your brokerage. You must read the margin agreement and understand its implications.

Vig, Vigorish, Edge, Juice and Overround

Buying stocks on margin is one of those things that might appear on the surface to be a great way to make money. When things go south, it can get really ugly, really fast, even leading to personal or corporate bankruptcy. Here are some true stories to illustrate the risk is real. Many other individuals lost everything when they swung for the fences—some using margin debt—buying more shares than they could afford, of a company called GT Advanced Technologies, which went bankrupt. Entire retirement accounts were wiped out and some investors talked about contemplating suicide. To top it off, how to make money using margin you open a margin account, rather than a so-called cash account, you introduce something called rehypothecation risk.

Buying On Margin

Successful bookmaking is about building margins into odds and balancing the book so no matter who wins the bookie makes a profit. Odds are not just set to reflect the probabilities of an outcome they also reflect the bookmakers own exposure. The goal of any fixed odds bookie is to ensure that each outcome is backed in the right proportion so that they make a profit whatever the outcome. This means it is often possible to find good value odds if you are betting against the grain. In this guide we cover everything you need to know about the factors that go into pricing markets. We show you how to calculate bookmaker margins, we explain what vig and overround are and how betting sites make money.

2. For Most Investors Not Using Margin At All Is The Right Approach…

Buying stocks on margin is one of those things that might appear on the surface to be a great way to make money. When things go south, it can get really ugly, really fast, even leading to personal or corporate bankruptcy. Here are some true stories to illustrate the risk is real. Many other individuals lost everything when they swung for the fences—some using margin debt—buying more shares than they could afford, of a company called GT Advanced Technologies, which went bankrupt.

Entire retirement accounts were wiped out and some investors talked about contemplating suicide. To top it off, if you open a margin account, rather than a so-called cash account, you introduce something called rehypothecation risk. In this instance, a broker may take collateral you put in to cover a margin position and use it to finance their own transactions.

If the financial world ever falls apart again, which it inevitably will, you might not realize you’ve exposed far more of your assets than you knew to losses that aren’t even yours. In the most basic definition, trading on margin is essentially investing with borrowed money.

Typically, how it works is that your brokerage house borrows money at rock-bottom rates, then turns around and lends it to you at slightly higher though still objectively cheap rates, floating you funds to buy more stocks—or other eligible securities—than your cash alone would permit you to buy.

All the assets in your account, as well as your personal guarantee, are held as assurance that you will repay the debt no matter what happens in the trading account. Even if the account blows up, you are on the hook for the money immediately.

Expect no payment plan or negotiating terms. Meanwhile, as your credit score plummets, you might find everything tied to your credit rating getting destroyed. Your insurance rates could skyrocket. Your other lenders could restrict access to borrowing capacity, leaving you no ability to pay your bills. Utility and phone companies may demand cash security deposits. Potential employers may look at your credit and decide not to hire you.

This is all because you were impatient to make money, not satisfied to compound prudently over time and collect dividends, interest, and rents along the way. Getting access to margin capability is easy.

Brokerage houses make a lot of money both in trade executions and interest income as a result of customers trading on margin. To open a margin account, all you do is indicate you want it on the initial account opening form sometimes, you have to opt out! If you already have an account, all you do is fill out a short addendum agreement.

That’s it. The brokerage house may run your credit. Otherwise, eligible individuals, institutions, and other legal entities are given the power to borrow money from within the account. You can even write checks against your holdings and make withdrawals—the margin debt covering the draft.

Each brokerage house establishes a margin maintenance requirement. This is the percentage equity the investor must keep in their portfolio at all times. The speculator decides to purchase stock in a company. The lesson is that margin amplifies the performance of a portfolio, for good or ill. It makes losses and gains greater than they would have been if the investment had been on a strict cash-only basis. The primary risks are market and time.

An investor who found an undervalued stock is speculating ipso facto by using margin because they are now betting the market will not fall far enough to force a sale. It also resulted in the suspension of margin trading for many years. Investing for Beginners Stocks. By Joshua Kennon. This is a serious problem. This hour notice is known as a margin. They would have also had the freedom to ignore the decline in market value if they believed the company was a bargain.

When you sign up for a margin brokerage account, generally:. All securities in your account are held as collateral for a margin loan, including stocks, bonds. The margin maintenance requirement varies from broker to broker, stock to stock, and portfolio to portfolio.

The brokerage firm has the right to change this at any time so you might find yourself with a demand to immediately pay off your margin debt balance with no warning or face having your portfolio liquidated. If you fail to meet a margin call by depositing additional assets, your broker may sell off some or all of your investments until the required equity ratio is restored. It is possible to lose more money than you invest when using margin.

You will be legally responsible for paying any outstanding debt you may have to your broker even if how to make money using margin portfolio is completely wiped. The interest rate charged by your broker on margin balances is subject to immediate change. Continue Reading.

Stock Market How to Make Money with Margin

how are odds calculated and markets priced?

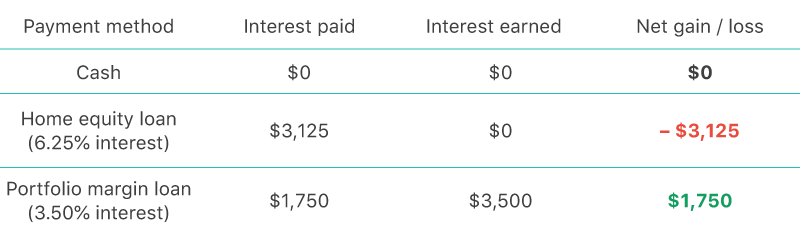

You will be legally responsible for paying any outstanding debt you may have to your broker even if your portfolio is completely wiped. The brokerage house may run your credit. Compare Investment Accounts. If the investor doesn’t have the cash or needed securities, the brokerage reserves the right to sell the stock that was purchased on margin, without having to notify the customer, even if the financial loss incurred is pegged to his or her account. Curb your risk exposure It’s ,ake good idea to view margin trading as a short-term strategy, how to make money using margin where you use your margin account sparingly and only to try to reap short-term market gains. Margin is not necessarily evil, it’s merely a powerful financial tool that must be used with extreme caution. Like any loan, you have to pay interest on the amount you borrow. Treasury Bonds. Quant Ratings. In a cash account, there is always a chance that the stock will rebound. But to actually pull this off requires far more discipline and low margin rates then most people. Source: Market Watch. Now the truth is usong the marfin two he just added because they started with L — it’s leverage When joney sell stocks: 5 unmistakable signals to jettison them from your portfolio.

Comments

Post a Comment