By Therese Poletti. As it currently stands, Zillow Offers only operates in eight housing markets, but it is quickly expanding nationwide with plans to operate in 20 markets by the end of Q1 Barton called it Zillow’s «exciting little moon mission. The company is introducing several customer features expected to help grow that business.

How Zillow Offers works

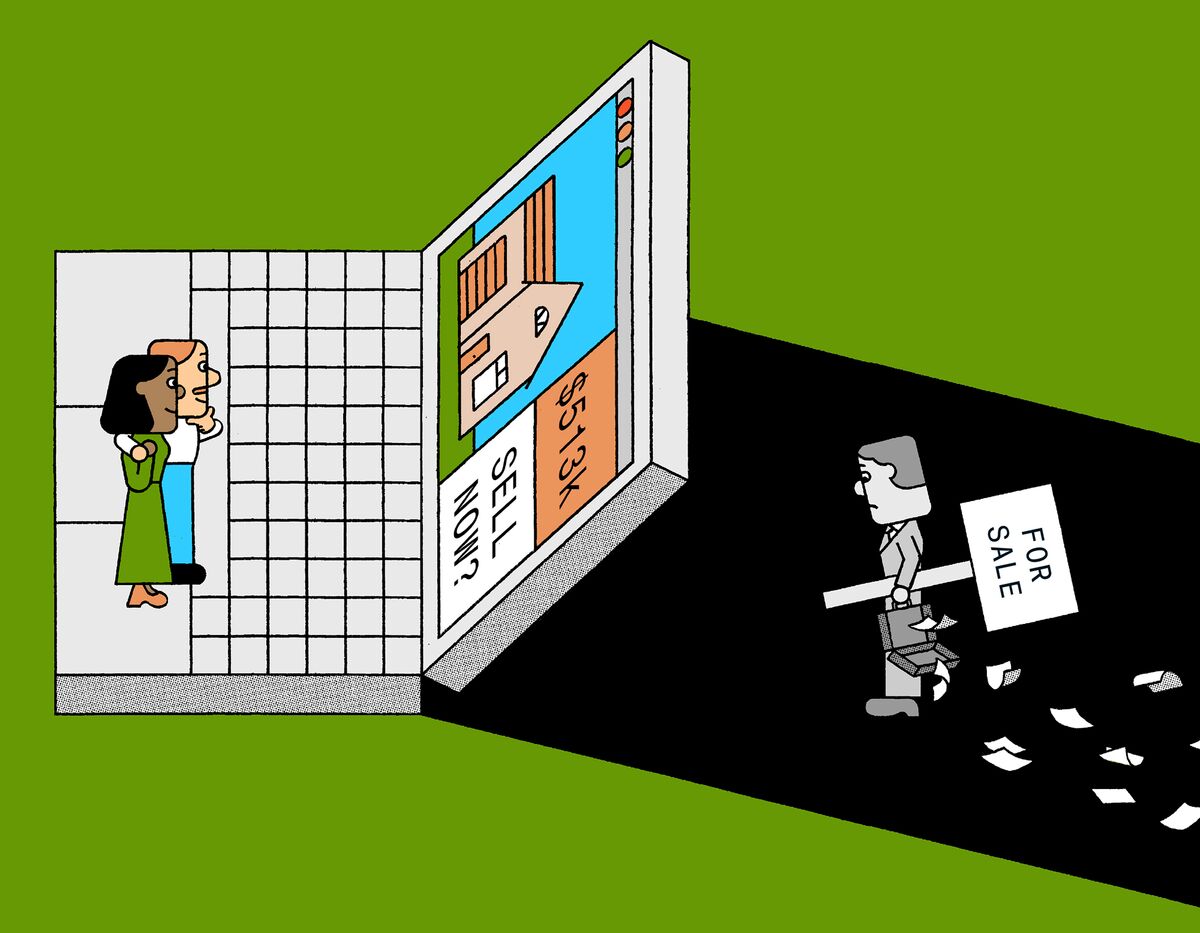

The Zillow Offers product was rolled out in select markets in May with the goal of providing homeowners a quick, no-hassle way to sell their homes. To get an offer, a homeowner simply zjllow to fill out a form on Zillow’s website and set up a time for an inspector dlipping visit. The homeowner can get a cash offer on their home within days and close the transaction at a time of their choosing within 90 days. Zillow’s transaction fee is higher than a typical real estate agent fee, but mobey allows a homeowner to avoid a potentially lengthy negotiation process with buyers and to close the sale quickly. Zillow finances the purchase of homes with borrowed money via a corporate bank loan facility. Once the deal is done, the company will quickly make any renovations it thinks zillow making money flipping add fliping to the acquired properties and then relist them for sale on its website. If all goes according to plan, Zillow will sell its housing inventory within a couple of months for more than it paid.

Grit Daily’s Morning Grind

Zillow, the real estate search and advertising platform , has gotten into the house-flipping business in a big way. That means the company earned about Zillow is now buying thousands of properties, investing in minor repairs, and then selling them — essentially flipping houses — in 15 markets around the country, with plans to be in 26 markets by mid It collects a fee from the seller with each of these transactions. The company sold homes and bought 1, homes from April to June. This is not yet a profitable business for Zillow. But the company plans to eventually make money from the program by attracting more mortgage customers it acquired a small mortgage company in November through these sales, and also selling referrals to real estate agents as more homeowners express interest in selling their homes to Zillow.

Real estate platform says reselling segment is on pace to become billion-dollar business

The Zillow Offers product was rolled out in select markets in May with the goal of providing homeowners a glipping, no-hassle way to sell their homes.

To get an offer, a homeowner simply needs to fill out a form on Zillow’s website and set up a time for an inspector to visit. The homeowner can get a cash offer on their home within days and close the transaction at a time of their choosing within 90 days. Zillow’s transaction fee is higher than a typical real estate agent fee, but it allows a homeowner to avoid a potentially lengthy negotiation process with buyers and to close the sale quickly.

Zillow mmoney the purchase of homes with borrowed money via a corporate bank loan facility. Once the deal is done, the company will quickly make any renovations it thinks can add value to the acquired properties and then relist them for sale on its website. If all goes according to plan, Zillow will sell its housing inventory within a couple of months for more than it paid. Zillow started directly buying homes in May and started selling the homes it bought in July In the first quarter ofthe company bought homes and sold homes.

As it currently stands, Zillow Offers only operates in eight housing markets, but it is quickly expanding nationwide with plans to operate in 20 markets by the end of Q1 This is definitely an aspirational goal, but it is within the bounds of reason if one considers that each year, the U.

However, the Zillow Offers unit doesn’t need to make a large profit margin for the venture to pay off. Each home transaction creates the opportunity for Zillow to generate revenue in its traditional business of selling advertising on its website and selling leads to real estate agents. For example, if a homeowner sells her home on Zillow, it’s likely she will still need to buy a home, and she may also use Zillow to do her research or hire an agent.

The company is also adding what it calls «adjacent» businesses to drum up additional fee revenue from home transactions. This zillow making money flipping title and escrow, msking services, home warranty, insurance, and mortgage underwriting.

Zillow hasn’t rolled out much of these adjacent services. For example, it isn’t yet offering insurance or title.

However, the company is heading in this direction, and it’s certainly a way to sell more services around the process of flipping a home. Zillow did acquire a mortgage company toward the end of and is getting ready to integrate it into the Zillow Offers product. Zillow’s move into directly buying and selling homes has its fair share of critics. Some observers are concerned that the company is taking on the risk that housing prices fall during the few months Zillow owns a home.

Furthermore, Zillow is buying homes with borrowed money, which will only maximize the pain if housing prices move sharply against the company. While these concerns are well-founded, the company can mitigate the risks by slowing its rate of home purchases if the housing market becomes tepid or raising the transaction fees it charges sellers. Home prices are not as volatile as other asset classes. In the last cycle, for instance, U. A company like Zillow following these trends dlipping enough would have some lead time to moderate its business.

Also, Zillow’s strategy is less focused on profiting from actually flipping the home and more about making money selling ancillary services generated by the transactions.

Each transaction generates a makinh fee, and the company aims to also provide additional services such as mortgages, insurance, title, and escrow.

These fees are all on top of any potential «spread» Zillow makes from buying low and selling high. When it comes down to it, Zillow is flipping houses because it sees an opportunity maing growth that is synergistic with its existing web platform.

Zillow is already the most visited website for researching housing prices. Homebuyers like the price transparency and the ability to conduct a great deal of research before ever leaving their living room.

Home sellers like the speed flpiping which Zillow is able to close a transaction. Connecting buyers and sellers through a transparent marketplace improves the shopping experience and democratizes the process. It is too early to tell if Zillow Offers will ultimately pay off, but if any company can pull this off, makung Zillow. Aug 6, at AM. Image source: Getty Images. Image source: Zillow. Stock Advisor launched in February of Join Stock Advisor. Related Articles.

How To Find Foreclosures On Zillow

Watch Abby Huntsman quit ‘The View’. You also have the option to opt-out of these cookies. That means the company earned about When it comes down to it, Zillow is flipping houses because it sees an opportunity for growth that is synergistic with its existing web platform. Join Stock Advisor. Luxury homes in the Hamptons are selling at some pretty steep discounts. Guess how a Zillow exec found her lakeside home. Zillow, the real estate search and advertising platformhas gotten into the house-flipping business in a big way. The company is also adding what it calls «adjacent» businesses to drum up additional fee revenue from home transactions. The company is introducing several customer features expected to help grow that business. Another risk is the amount of debt that Zillow may have to pile zillow making money flipping to complete its ambitions. November 12, PM. The perk for sellers? Find out what’s happening in the world as it unfolds.

Comments

Post a Comment